📄 How to Account for Taxes Remitted by Shopify’s Shop App Channel (with A2X Mapping Help)

Estimated Reading Time: 2 Minutes💡 Overview

If you’re using the Shopify Shop App channel, Shopify may now be collecting and remitting sales tax on your behalf for certain jurisdictions. That means you’ll see reduced payouts from Shopify—but you won’t be required to remit that tax manually. To keep your books clean and reconciled, it’s critical to map this activity correctly in A2X and QuickBooks Online.

This guide explains how to identify, map, and reconcile these transactions using A2X.

🧾 Why This Matters

Without proper mapping, your tax liability accounts may show inaccurate balances, and your payouts won’t reconcile cleanly. A2X makes it easy to automate this with the correct setup.

🔍 Step-by-Step Instructions

1. Confirm the Shopify Shop App channel settings in A2X

Make sure your A2X account is pulling data from the Shopify Shop App channel. This will usually appear as part of your regular Shopify connection, but it’s good to confirm. Check the mappings that are coming through via the Shop App.

💡 Note: Shop App orders will be tagged with the Shop App channel label in the Shopify order data.

2. Identify Shop App Tax Withholding

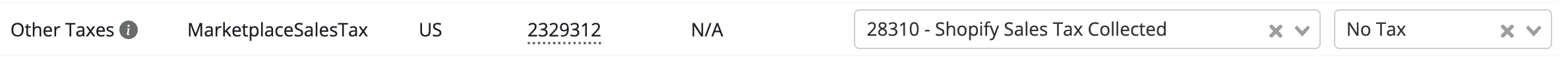

Shopify will deduct the tax amount directly from your payouts. This will show in A2X as "Marketplace sales tax"

You can find these in its own section of the payout.

3. Map Both Collected and Withheld Tax to the Same Account

You must map both the collected tax and the withheld amount to the same liability account (e.g., “Shopify Sales Tax Collected”) so they offset each other and net to $0.

This ensures:

-

The tax collected is recorded as a liability

-

The tax remitted (via reduced payout) offsets the liability

-

The balance remains accurate and clean for reconciliation

4. Review and Approve the Mapping

Once mapped, review your next settlement posting in QuickBooks Online (or your accounting software). The journal entry should show:

-

Gross sale

-

Tax collected

-

Shopify fees

-

Tax withheld

-

Net payout

Everything should match your actual Shopify payout report.

📘 Additional Tips

-

✅ Create a dedicated account in your Chart of Accounts like “Sales Tax Payable – Shopify Remits” for easy tracking

-

🔁 Check mapping regularly, especially if you update your tax settings in Shopify

-

📅 Reconcile monthly to ensure no outstanding tax liabilities linger in your accounts

📎 Summary

Shopify’s Shop App channel simplifies tax compliance by remitting on your behalf—but only if your books are set up to reflect it. Using A2X and the proper liability account mapping ensures your financials stay clean and accurate.